Avoiding Default

What is Default?

Loan default happens when someone who borrowed money can't make their payments on time, as agreed in the loan agreement. This can happen with different types of loans like personal loans, mortgages, car loans, and student loans. When a borrower defaults on a loan, it causes significant consequences for both the borrower and the lender.

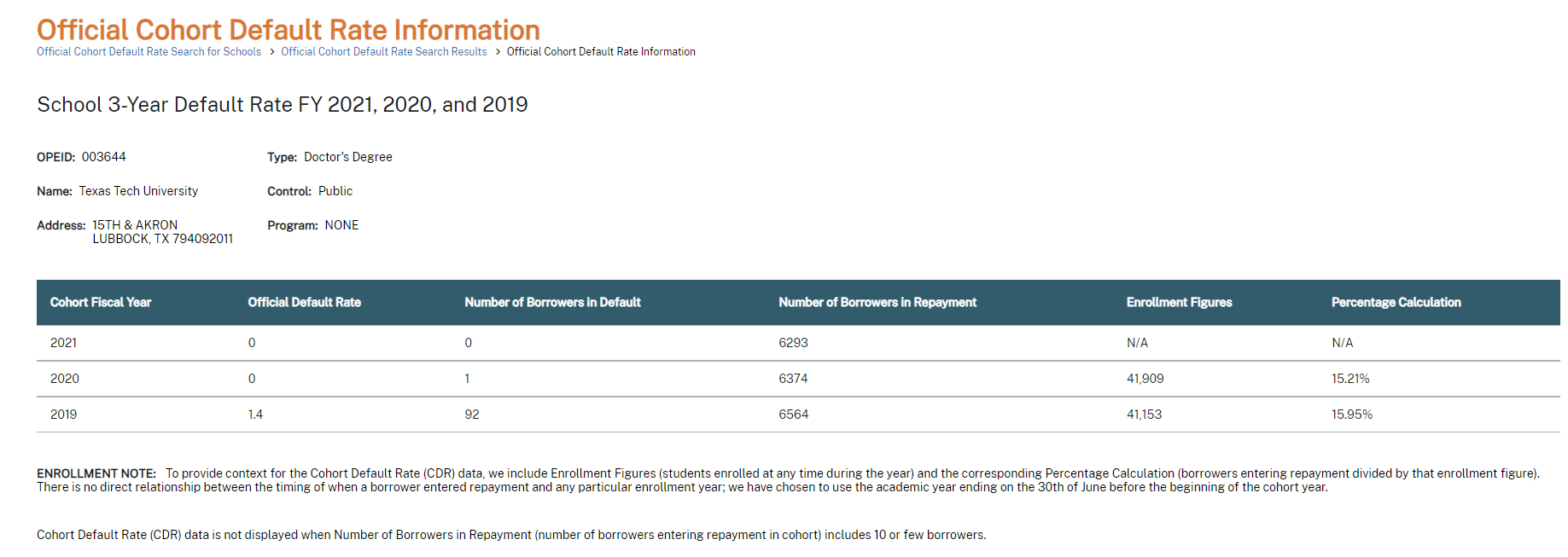

View the latest Texas Tech Cohort Default Rate below or click here. Use OPEID code 003644.

Loan Default FAQs

1. Financial Hardships: Life is unpredictable, and sometimes unexpected things happen, like losing a job, having medical problems, or when the economy is not doing well. These situations can make it hard for borrowers to repay their loans as planned. It might cause financial problems and lead to missing loan payments.

2. Poor Financial Management: A lack of financial planning and budgeting can be detrimental, as borrowers may struggle to allocate funds for loan repayments. Uncontrolled money spending habits and disorganization can contribute to defaulting on loans.

3. Excessive Debt Burden: Accumulating too much debt from various sources can strain a borrower's financial capacity. When the total debt burden surpasses an individual's ability to repay, default becomes a looming possibility.

4. Ignorance of Loan Terms: Some borrowers may not fully comprehend the complexities of their loan agreement. This lack of understanding can lead to unintentional defaults due to missed deadlines or failure to comply with specific conditions.

In general, a federal student loan is placed in default when a borrower doesn't make a payment and has been unreachable or unresponsive to requests for payment for 270+ days after the first missed payment.

After a borrower misses a payment his/her loan enters a delinquency period. During the delinquency period, the lender must make repeated efforts to locate and contact the borrower about repayment. If the lender is unsuccessful, steps will be taken to place the loan in default.

When a student Graduates, withdraws or drops below half-time.

1. Negative Impact on Credit Score: One of the biggest impacts of a loan default is, it will reduce your credit score so that you could not apply for loan again. Borrower with a lower credit score will get loan but generally at higher interest rates.

2. Legal Actions and Collection Efforts: Lenders have the right to take legal action to recover the outstanding debt. This could involve filing a lawsuit, obtaining a court judgment, and even seeking wage garnishments. Additionally, lenders or third-party collection agencies may engage in aggressive collection efforts.

3. Limited Financial Opportunities: Loan default can negatively impact various aspects of the borrower's financial life. It may hinder their ability to secure rental housing, obtain insurance coverage, or even impact their employability, as some employers conduct credit checks on potential employees.

4. Impact on Co-Signers: In cases where a loan has a co-signer, the default can have severe consequences for the co-signer's credit score and financial standing.

Borrowers who have difficulty making loan payments should contact the lender as soon as possible to see which options are available to them. Borrowers who try to avoid their lender could lose out on some readily available repayment benefits and options.The best way to avoid defaulting on your loan is to make payments on time!Discover steps you can take to repay your federal student loan successfully and avoid going into default.

Don't get discouraged! If you are in default on your federal student loan, there are options for getting out of default, including loan repayment, loan rehabilitation, and loan consolidation.

If you're having trouble making payments or are concerned about the status of your federal student loan(s), you have options available to you. Contact your loan servicer to discuss how to get back on track with payments. There are several affordable repayment options that you may be able to take advantage of to continue making loan payments even when times are tough.

Financial Aid

-

Address

Texas Tech University | Student Financial Aid & Scholarships | West Hall 301 | P.O. Box 45011, Lubbock, TX 79409 -

Phone

(806) 742-3681 -

Email

finaid.advisor@ttu.edu