Information on retirement programs available to employees is available on the Human

Resources Website:

Teacher Retirement System of Texas (TRS)

TRS is a traditional defined benefit plan and a qualified governmental retirement

plan under the provisions of the U.S. Internal Revenue Code, Section 401(a).

TRS Home Page

TRS Publications (Newsletters, Brochures, etc...)

Keep Your Address Current

It is very important that TRS have your correct address on file as it is used for

mailing confidential information regarding your TRS account. As a reminder, TRS no

longer accepts address changes from the employer. Employees must update their address

with TRS in one of three ways:

- Mail a Change of Address Notification form (TRS 358)to TRS.

- Mail a written request to TRS. The letter must contain your social security number

or your TRS Participant ID number and your signature.

- Online as a registered user of MyTRS.

This information was communicated to members by TRS in the April 2018 TRS newsletter.

Hours Worked

Due to new TRS reporting guidelines that went into effect September 1, 2017, TRS now

monitors the total number of hours an employee is paid for in the month. As a reminder,

employees classified as Benefits Eligible MUST work and/or submit leave time each month for a minimum of hours equivalent to one-half time. If the employee does not meet this requirement

they may forfeit their TRS membership. For example:

January has 22 work days (Monday–Friday)

22 x 8 = 176 work hours available

176 / 2 = 88 hours to equal one-half time

A minimum of 88 hours, worked and/or submitted as leave time, would be required for the month

of March.

For questions please send an email to webmaster.payroll@ttu.edu.

Refund of TRS Account

As a TRS member, if you permanently terminate all employment with your TRS-covered

employer(s) and have neither applied for nor received a promise of employment with

a TRS-covered employer, you may terminate membership in TRS and withdraw all of the

accumulated contributions (plus interest) in your member account.

Members can submit a refund request electronically by logging in to the MyTRS member portal. Alternatively, you may complete a TRS 6 Application for Refund. Once the form has been completed and notarized, it should be mailed directly to

TRS following the instructions given on the application.

TRS will contact Texas Tech for certification of employment termination. The termination

cannot be certified until your department has processed the employment termination

paperwork and your final paycheck has been processed.

TRS typically processes refunds within 60 days after your final deposit has been posted

to your account. Due to TRS reporting guidelines, deposits must be reported based

on the check date and cannot be submitted to TRS until the first week of the month

following the final check date. For example, if your termination date is March 31st,

your final deposit would be included on your April 10th check if paid semi-monthly

or April 1st check if paid monthly. The April report cannot be submitted to TRS until

the first week of May. The deposit will be posted to your account once the report

clears all TRS edits which can take approximately two weeks.

To check on the status of your refund contact TRS at 1-800-223-8778.

Working Retirees

If you are retired from TRS and thinking about returning to work with an employer

covered by TRS, OR you are thinking about retirement and considering possible employment with an employer

covered by TRS after you retire, the Employment After Retirement guide will help you make the decision that is right for you and avoid any unexpected

loss of annuity payments.

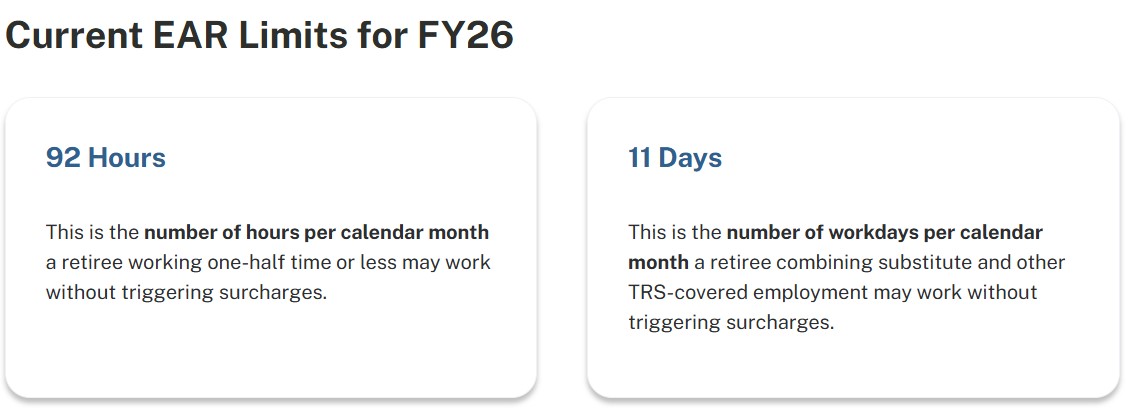

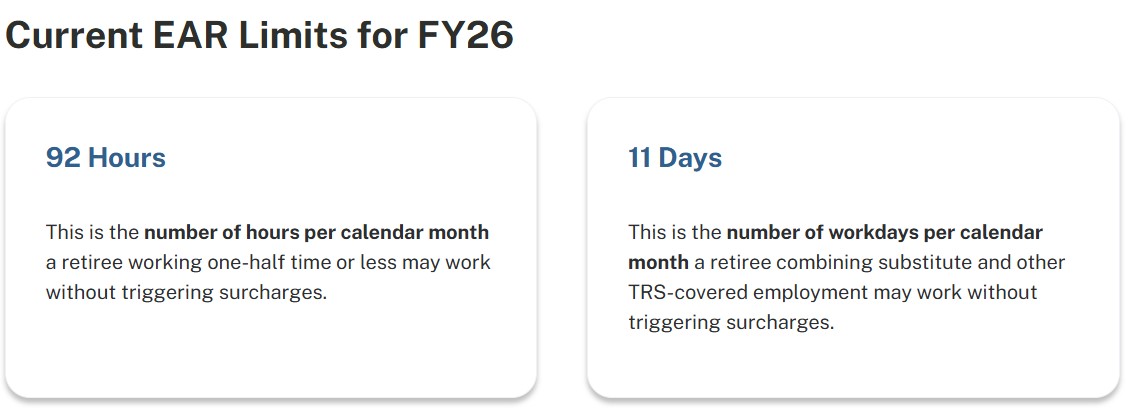

Work hours allowed when limited to working one-half time or less:

For questions, please request assistance via the Payroll & Tax Services Customer Portal.

Working Retiree Surcharges – ATTN: DEPARTMENTS

If you hire a TRS retiree who retired after September 1, 2005 and they work more than one-half time (50% FTE) in a calendar month,

the department is required to pay a surcharge of 16.5% of the total salary paid in

that month. If the retiree is enrolled in TRS Care health coverage, you may also be

responsible for the employer portion of the premium.

For questions, please request assistance via the Payroll & Tax Services Customer Portal.

Texas Optional Retirement Program (ORP)

The Optional Retirement Program (ORP) is an individualized retirement plan in which

each participant selects from a variety of investment products offered by insurance

and investment companies that are authorized by the employing institution. Tax-deferred

contributions made by both the state and the employee each month are sent by the institution

to the selected ORP company to purchase annuities or mutual fund investments authorized

under Section 403(b) of the Internal Revenue Code.

To enroll in or update your ORP elections, log into Retirement Manager or contact your Human Resources office.

Texas Tech does not have information on your account such as investments, balance,

growth, losses, etc. You will receive statements from your ORP companies that provide

this information. Companies send out statements at different times, monthly, quarterly,

semi-annually or annually. You will need to contact your company to find out how often

their statements are generated.

For information on vesting, transferring of funds, or withdrawals, please contact

your respective Human Resources Department:

Elective Retirement Plans

Elections and updates to contributions are made using Retirement Manager.

Texas Tech does not have information on your account such as investments, balance,

growth, losses, etc. You will receive statements from your TDA companies that provide

this information. Companies send out statements at different times, monthly, quarterly,

semi-annually or annually. You will need to contact your company to find out how often

their statements are generated.

403(b) Deductions

Elections and updates to contributions can be completed using Retirement Manager.

For more information, please contact your Human Resources office.

Texa$aver 457 Program

Deduction information feeds electronically from ERS into the payroll system. Changes

to your payroll deductions will be effective for the pay period beginning on the first

of the month following the month in which the changes are processed by ERS.

Elections and updates to contributions can be completed online on the TexaSaver Empower Website.