Cost Sharing

Cost Sharing

Cost share (also known as match) refers to all contributions that Texas Tech University makes to a sponsored project. In other words, this is the portion of the project that is not borne by the sponsor. All items of cost share must be expended within the project period and must be compliant with the applicable regulations and institutional policy. As a project cost, cost share is also subject to audit.

Federal requirements require that match contributions meet all the following criteria:

- Are verifiable from the non-Federal entity's records;

- Are not included as contributions for any other Federal award;

- Are necessary and reasonable for accomplishment of project or program objectives;

- Are allowable under 2 CFR 200 Subpart E—Cost Principles;

- Are not paid by the Federal Government under another Federal award; and

- Are provided for in the approved budget when required by the Federal awarding agency.

Types of Cost Share

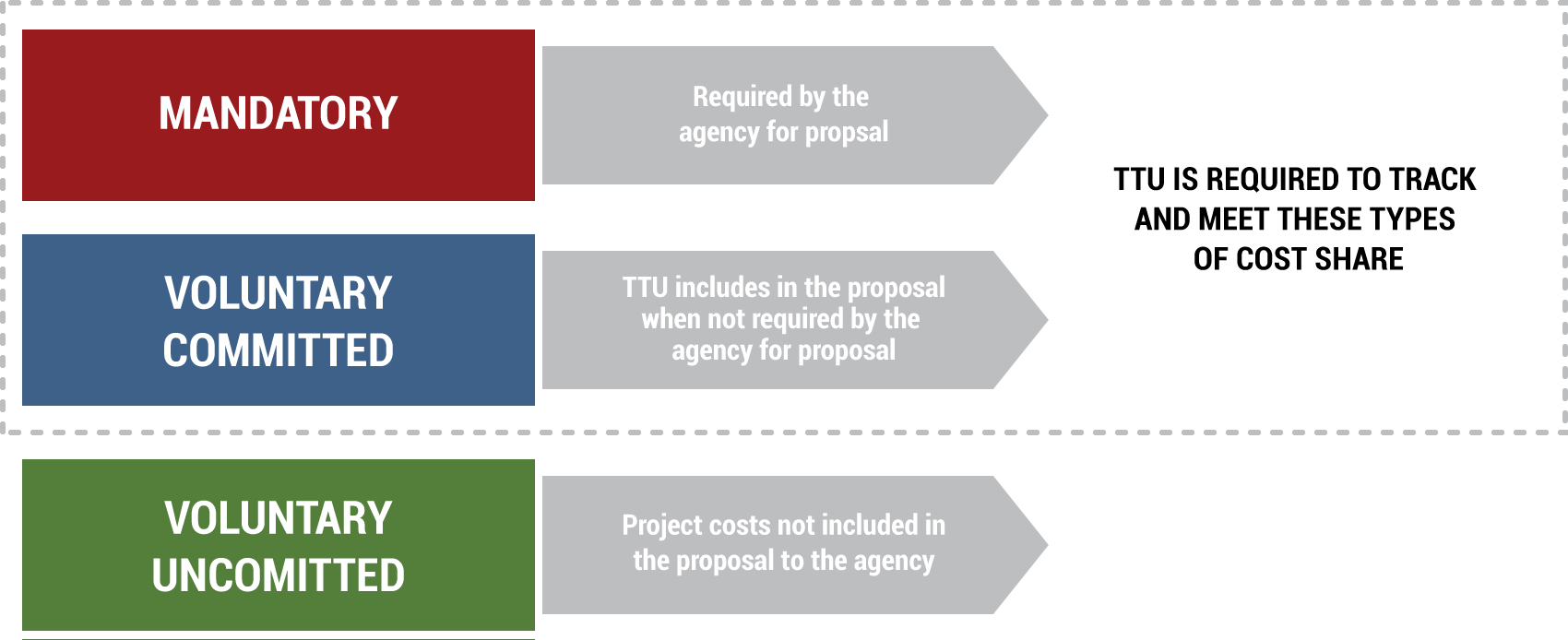

When cost share is required by a sponsor as part of the proposal submission (mandatory cost share) and/or when Texas Tech includes quantifiable contributions to a project in a proposal not required by a sponsoring agency (voluntary cost share), TTU must track report the committed match.

Other costs paid by TTU that support the project but were not committed to the agency in advance in a proposal budget are considered voluntary uncommitted cost share. Texas Tech is not required to track or report these expenses. Voluntary cost share is discouraged in proposals when not required as part of the solicitation for this reason.

Cost share may be comprised of cash or non-cash items from Texas Tech University or another third party contributor (such as a sub-recipient).

Accounting Records

Where there is a required cost sharing commitment (mandatory or voluntary committed), the Office of Research Services (ORS) will work with the principal investigator (PI) at the proposal stage to develop the cost share budget and to identify source(s) of funds for cost sharing. Once funded, expenditures must be recorded in the established fund-organization-program accounts (FOPs) to be counted toward the cost share commitment. Accounting Services uses the proposed cost share budget to setup these FOPs and tracks expenses that cannot be documented in the accounting system such as the following:

- Fringe benefits and tuition remission on state-appropriated funds

- F&A and unrecovered F&A costs

- Third party contributions

- Other In-Kind contributions

Additional information on cost sharing policies may be found in TTU OP 65.07 Cost Sharing on Sponsored Projects.

For additional questions, Research Administrator contacts can be found by college and department in the Accounting Services Find My Research Administrator contact listing.

Research Accounting

Accounting Services

-

Address

TTU Plaza Building, 1901 University, Suite 308, Lubbock, TX 79411 -

Phone

806.742.2985 | Fax: 806.742.8076 -

Email

accountingservices@ttu.edu