After 42 years of banking, including 34 as a chairman, president, CEO or all of the above, Mike Mauldin planned to hang up his hat and retire comfortably.

Just as he began to share these plans in 2018, he was approached by several colleagues about the chance to become the inaugural director of the Excellence in Banking (EiB) program with the Jerry S. Rawls College of Business.

“I’ll be honest. That wasn’t something I dreamed about,” Mauldin said with a laugh.

But the more he thought about it, Mauldin decided he could not pass up the opportunity to create a program that would produce top-notch bankers. He was enticed to give students a comprehensive understanding of modern banking operations and practices through finance curriculum and courses on advanced banking topics.

“I’ve always said I like to take on challenging roles,” he said. “And in terms of getting something just established, for it to just maintain status quo is not really my cup of tea.”

This allows Mauldin more time with the students to coach them one-on-one.

Since the first commercial banking undergraduate certificates were awarded in fall 2020, 100% of graduates completing the program have job offers after their internships.

“The majority of them are going into regional banks right here in Texas,” Mauldin said, “but we’re also seeing them go into smaller community banks that offer a wonderful working environment. We have even had some of our graduates hired by multinational banks.”

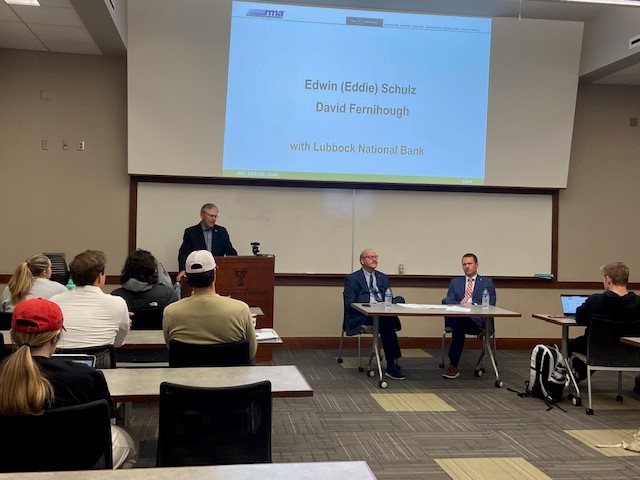

In addition to the required internships, students participate in a mentoring program and have opportunities for field trips to visit banks (including the Federal Reserve Bank in Dallas), attend conferences and workshops, a speaker series, student organization activities and other interactions with banking professionals and successful alumni.

To further ensure the program is preparing students for current industry demands, it is advised by a seasoned board of industry leaders. Further input is gathered from the EiB’s nearly 60 partner banks.

The support from the banking industry also is evident by the fact that to date, more than $14 million has been raised for the endowed EiB program.

Mauldin believes that the amount continues to rise because of the high ambitions for the EiB program. It has already grown from strictly finance majors to include accounting, ag business and ag finance with marketing on the way.

“When we asked our bank partners to compare our students to other universities, we had very good results,” he said. “They’re very happy with the students they’re getting and what they have learned. They’re pleased with how well prepared the students have been.”

EiB coordinator Whitnie Hill, who has helped the program run smoothly since its founding, was impressed by feedback she received earlier this year during the Texas Bankers Association Conference.

“I think the biggest compliment I’ve received so far was from someone I didn’t even know who told me one of our students received a scholarship from them and that student wrote her a handwritten letter – something she had never received before, and it sent chills up her spine.

“I was like, ‘I’m glad to hear that because we’re trying to teach them those skills to help set them apart from their peers.’”

Some of the other “soft skills” Mauldin wanted to be sure the program taught include elements of common courtesy: customer service, etiquette, proper introductions and interactions, and how to be conversational.

“The EiB program was career-defining and accelerating,” he said. “I learned skillsets on how to sell, how to talk to people and the importance of networking. We also touched on credit, loan structuring and the overall function of the bank. Graduating with that knowledge and experience was perfect.”

Once King completed his credit internship at First United Bank in Marble Falls in 2018, he received a full-time job offer. He had a smooth transition onboard and has worked there ever since, currently as a credit analyst.

“When I started the internship, I immediately knew what I was talking about from going through the EiB program,” he said. “I started off at a very base-level but after having taken some of those classes, I had exposure that gave me a leg up compared to other interns that went through different finance degree programs.”

“I’ll always be grateful for Mason doing what he did,” Mauldin said, “because the Rawls Banking Association has grown from 10 to 200 students, and that’s very exciting.”

Despite the significant growth experienced since King’s inaugural EiB class three years ago, Mauldin and Hill have continued their recruiting efforts.

“A lot of students don’t know what banking is or the kind of career they can have in it,” Hill said, “so we want to show them that you can be a credit analyst, a lender, or you could go and do mortgage or risk management. There are so many different avenues you can take besides being a teller.”

That’s the most rewarding aspect of Mauldin’s unexpected job: helping the next generation achieve the American dream.

“That first wave of students have all gone out and are already being elevated,” he said. “I’m hearing back from their banks about how well they’re doing, and just like they’re my own children, it makes me proud. And when I see them go on and accomplish more than I ever expected, that makes me even prouder.

“I came here to build the foundation of a great program, and my dream is that I never see how great it is because it’s constantly improving. I hope it will be here for a long, long time because we will need banking and finance as long as we continue to have society.”